child tax credit november date

Entered your information in 2020 to get stimulus Economic Impact payments with the Non-Filers. These updated FAQs were released to the public in Fact Sheet 2022-29PDF May 20 2022.

Due Dates For The Month Of October Accounting And Finance Due Date Dating

The American Rescue Act of 2021 temporarily increases the Child Tax Credit up to 3600 per child under age six and up to 3000 per child under age 18.

. Any insurance policy premium quotes or ranges displayed are non-binding. Go with the total amount reflected on the online IRS account because it has the most up-to-date information regarding the CTC. The United States federal child tax credit CTC is a partially-refundable tax credit for parents with dependent childrenIt provides 2000 in tax relief per qualifying child with up to 1400 of that refundable subject to an earned income threshold and phase-in.

Who is Eligible. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. We do our best to ensure that this information is up-to-date and accurate.

Enter Payment Info Here tool or. This tax credit is changed. Eligible families can claim a Child Tax Credit of up to 3600 per qualifying child.

Who Qualifies for the Child Tax Credit. The IRS has now processed the sixth December and final round of advance 2021 monthly payments for the expanded Child Tax Credit CTC to parents and guardians with eligible dependents. Frequently asked questions about the Advance Child Tax Credit Payments in 2021 Topic A.

Final date to update information on Child Tax Credit Update Portal to impact advance Child Tax Credit payments disbursed in. Like most tax credits the Child Tax Credit has a phaseout at certain income levels. In the year 2021 following the passage of the American Rescue Plan Act of 2021 it was temporarily raised to 3600 per.

Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or. The child tax credit is worth up to 3600 per child in 2021 and eligible filers can receive half their credit in advance through automatic monthly payments. November 15th 2021.

For an individual to be eligible for the Child Tax Credit the following six tests must be met. December 15 2021.

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What Is The Difference Between Refundable And Nonrefundable Credits Tax Policy Center

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Child Tax Credit Will There Be Another Check In April 2022 Marca

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

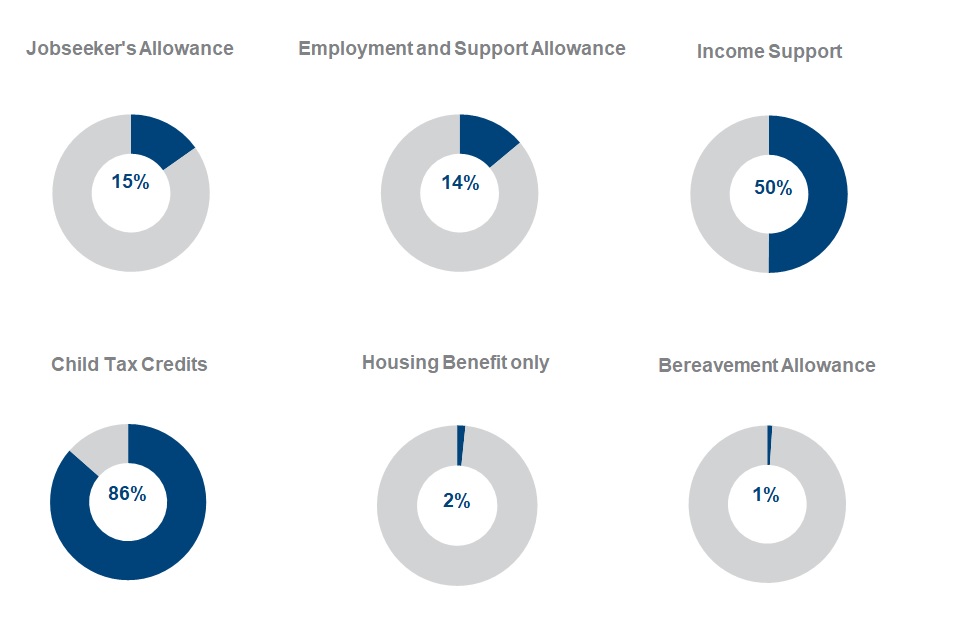

Benefit Cap Number Of Households Capped To November 2021 Gov Uk

Safeguarding Tax Credit Of Every Tax Form 26as Tax2win Online Taxes Filing Taxes Income Tax

Refundable Tax Credits Congressional Budget Office

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

One Week Left To Renew For 300 000 Tax Credits Customers Gov Uk

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back